solar rebates and incentives bring big opportunities for solar. There are no opportunities for solar homeowners or small scale projects.

ParlInfo – Future Made in Australia (Production Tax Credits and Other Measures) Bill 2024

Summary for Solar Homeowners – with Solar Rebates and Incentives Context

Pathway for a Solar Homeowner to Profit from the Hydrogen Production Tax Incentive

(by funding or co-owning an eligible hydrogen company)

1. Form or invest in a company that produces renewable hydrogen

Since only companies can claim the HPTI, a solar homeowner could:

- Start a new company, or

- Invest in an existing hydrogen or renewable-energy company.

The company must:

- Be an Australian resident company (with an ABN), or a foreign company operating a permanent establishment in Australia.

- Register for tax and comply with ATO reporting.

- Produce hydrogen in Australia using renewable electricity, such as solar power.

This transforms you from a homeowner into an investor or shareholder in a business eligible for the tax offset.

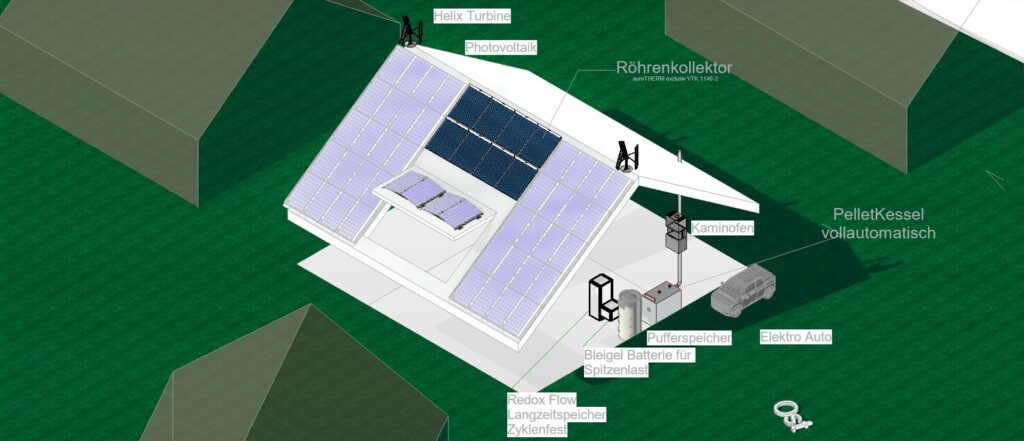

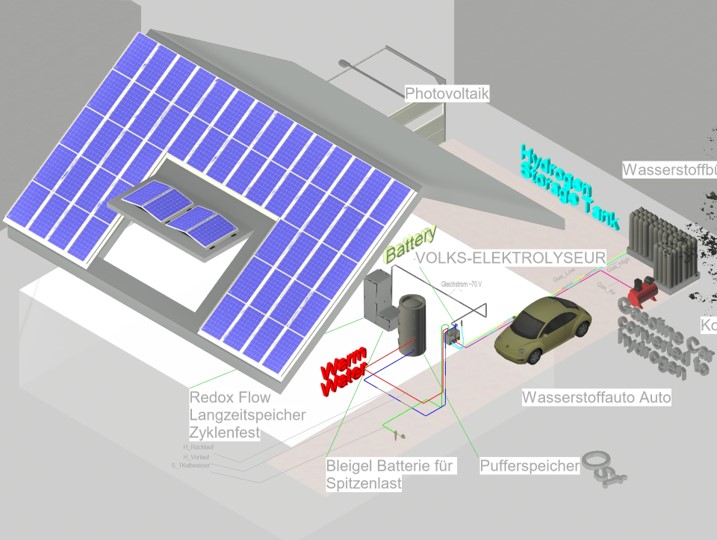

2. Build or participate in a solar-powered hydrogen facility

The company (which you partly own or fund) would need to:

- Install electrolysers powered by solar energy (or solar + battery) to split water into hydrogen and oxygen.

- Register the facility with the Clean Energy Regulator under the Guarantee of Origin (GO) Scheme.

- Demonstrate that hydrogen production emissions intensity is below 0.6 kg CO₂ per kg H₂ (the threshold for “renewable hydrogen”).

Your solar electricity could be part of the input to this facility — for example:

- You might sell your surplus solar energy to the company under a Power Purchase Agreement (PPA).

- Or, if you are co-located (e.g., in a regional cooperative), your solar generation could directly supply the hydrogen system.

3. Obtain certification and claim the Hydrogen Production Tax Incentive

Once the facility is registered and certified under the GO Scheme, the company becomes eligible for:

- A refundable tax offset of $2 per kilogram of renewable hydrogen produced and sold (or used for eligible purposes).

For example:

If the company produces 1,000 tonnes (1 million kg) of hydrogen in a financial year, the tax credit is $2 million.

That credit:

- Is claimed by the company in its tax return;

- Can be refunded in cash if it exceeds the company’s tax liability (it’s a refundable offset);

- Directly boosts profitability or cash flow.

4. Share in the profits as an investor

As a solar homeowner who helped fund or co-own the company, you could profit in several ways:

- Dividends: When the company receives the tax refund and generates profit, it may distribute dividends to shareholders.

- Capital growth: The company’s valuation increases due to ongoing HPTI receipts, raising the value of your investment.

- Power sales income: If your household or cooperative sells renewable power to the hydrogen company, you earn income for your energy.

So, while you personally can’t claim the $2/kg credit, your company can, and you benefit as a shareholder or energy supplier.

5. Example: Solar Cooperative Hydrogen Venture

Here’s a simplified illustration:

| Step | Description | Who benefits |

|---|---|---|

| 1 | Ten solar homeowners pool funds ($100k each) to create SolarH₂ Co Pty Ltd | All shareholders |

| 2 | The company installs 5 MW of electrolysers powered by a community solar farm | The company |

| 3 | The facility produces 1,000 tonnes of renewable hydrogen per year | The company |

| 4 | Company claims $2 million HPTI refundable offset via ATO | The company |

| 5 | After costs, company declares $1 million profit, pays dividends | Homeowners receive returns |

6. Practical considerations

To make this pathway work, you would need to:

- Engage legal and tax professionals to set up a compliant corporate structure.

- Register under the Guarantee of Origin scheme for hydrogen certification.

- Meet the community benefits test (e.g., local job creation, supply-chain participation).

- Secure necessary permits, water access, and grid connection.

- Manage operational scale — typically multi-megawatt facilities are required for economic viability.

7. Why this matters for solar homeowners

This approach allows a solar homeowner to:

- Turn small-scale renewable assets into equity in a hydrogen business.

- Participate in national hydrogen growth supported by government policy.

- Profit indirectly from the Hydrogen Production Tax Incentive, which is otherwise inaccessible to individuals.

8. Summary of the pathway

- Form or join a company (with other solar homeowners or investors).

- Develop or fund a solar-powered hydrogen project.

- Certify it under the Clean Energy Regulator’s Guarantee of Origin scheme.

- Claim the $2/kg HPTI through the company.

- Profit through dividends, energy sales, or capital growth.

sadly only 10 megawatt electrolysers are eligible, solar homeowners can not profit