hydrogen stocks can be an interesting investment. What the normal investor may not know is, that he’s cutting his own flesh.

While big companies develop large scale hydrogen projects with your capital, the infrastructure for your own dependence is made. Enormous Megawatt Electrolysers are built all over the world.

Hydrogen stocks: The future of green Energy investment

In a world, that increasingly enlarges renewable energy capacities and reduces greenhouse gases, hydrogen stocks gaine importance. Hydrogen is the promising candidate for long term energy storage of intermittent wind and solar. The used cases are enormous. almost no fossil equipment can’t be converted to hydrogen.

Why hydrogen?

Hydrogen is the most abundant element in Univers, and if combined with Oxigen, Energy can be harvested. If H2O is separated Energy can be dumped. Hydrogen is the perfect dump load because Hydrogen can be stored for ages without temperature limits and losses. Fuel Cell Electric Vehicles FCEV’s for big load can transport goods without constrains in winter when left shut down, whereas lithium doesn’t like cold temperatures and is destroyed without heating.

green hydrogen versus gray hydrogen

Not every hydrogen production method is sustainable like gray or blue hydrogen. Green hydrogen is seen as the environmentally friendliest method. Green hydrogen is produced from wind, water and sun. Blue hydrogen is won by fossil fuels directly and gray hydrogen is won by fossil electricity. Investors on hydrogen stocks should concentrate on green hydrogen, because major accusation for weather events start to happen.

Who is profiting of hydrogen stocks?

As soon as the hydrogen infrastructure is ready, it will flow through your gas meter. As soon as you converted all your appliances with hydrogen consumers, the prive will rise. If you take a look at electromobility, that happend to EV drivers. After free charging station where available at the beginning of electromobility, fast charging became more expensive than fossil fuel to compensate the Investments for the charging infrastructure.

3 tips for Hydrogen investors

Behind the hydrogen stock market companies are there customers from fossil to governmental institutions.

- gradually enlarge your off grid setup with Photovoltaik, batteries and dc systems. these investment are proven

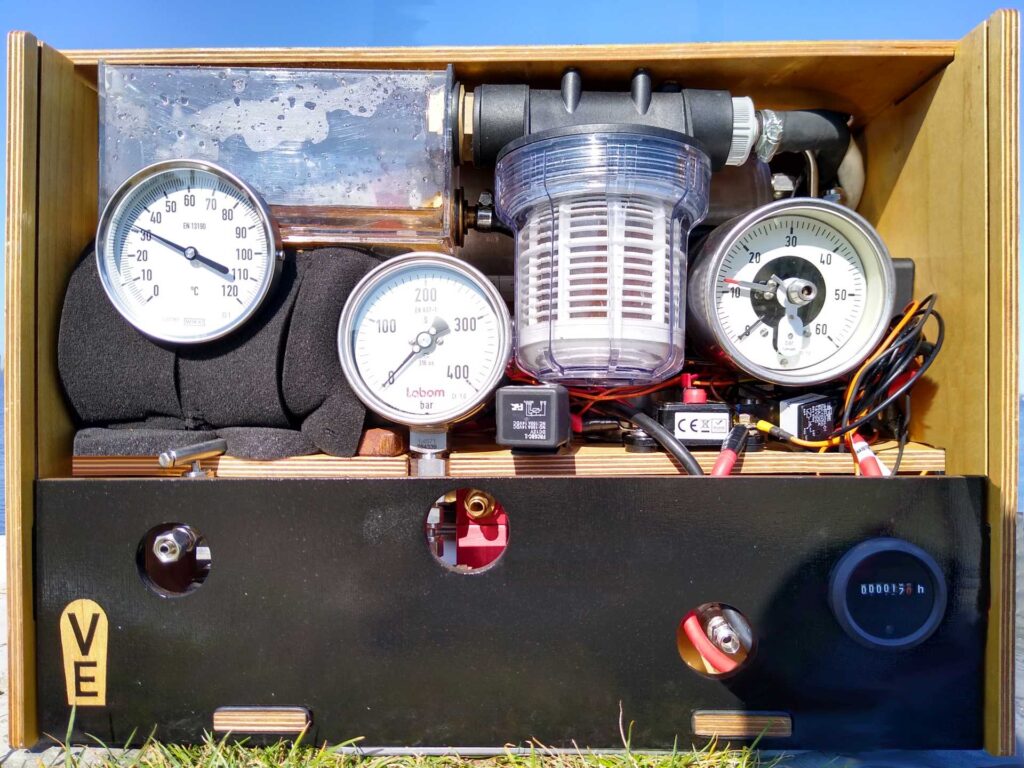

- better invest in your own hydrogen infrastructure like a home hydrogen refueling station

- Minimise risk of shares. Real noble metals like platinum are very stable.

Videos werden nur für Mitglieder angezeigt.

Wir bieten eine kostenlose Jahres Mitgliedschaft für jeden Beitrag in den sozialen Netzwerken mit mehr als 100 Ansichten über den Volks-Elektrolyseur. Verlinken Sie uns dazu einfach mit dem Beitrag. Vielen Dank!

Videos are only displayed for members.

We offer free 1 year memberships for every post on social media with more than 100 views about the Volks-Electrolyzer. Just link us to the post. Thank you!

Les videos sont seulement visible pour les membres.

Nous offrons un abonnement gratuit pour tout post générant 100 vues sur Volks-Electrolyzer. Il suffit de nous relier à votre post. Merci beaucoup!

and check electrolyzer cost of more than 40 hydrogen manufacturers to see our best value